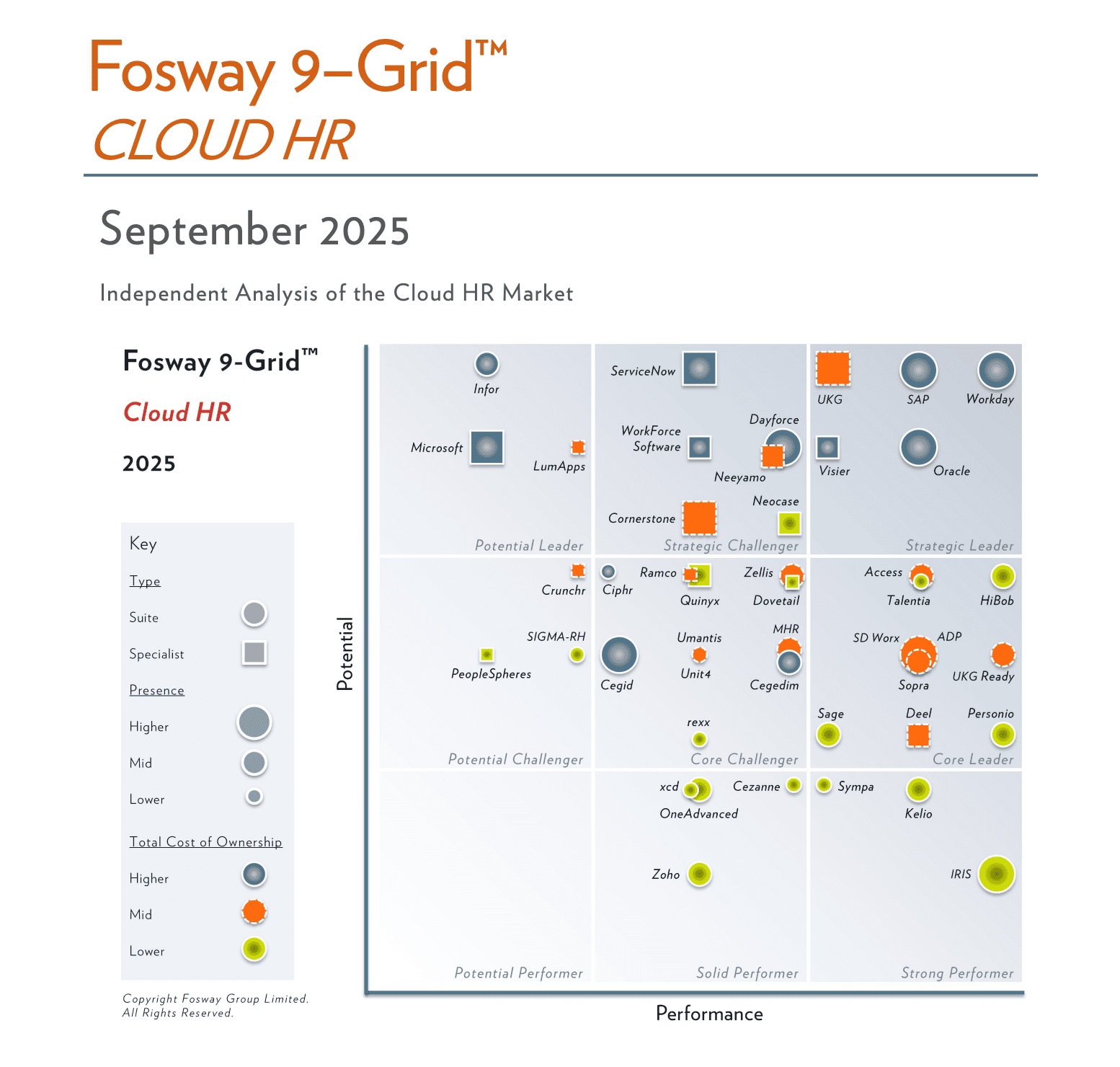

The latest Fosway 9-Grid™ for Cloud HR (September 2025) offers a sharp snapshot of how the HR technology market is shifting. As organisations look to balance cost, compliance and capability, it’s particularly telling to see which brands have gained ground compared to 2024, and why.

Movers Worth Noting

Several providers have stepped up their positions this year:

- Cezanne enters the Grid as a Solid Performer with a Lower TCO. This UK-headquartered suite is making a mark with affordability and agility. A combination attractive to mid-market buyers.

- HiBob continues its upward momentum, now firmly in Core Leader territory and again demonstrating a Lower TCO. It shows how challenger brands can scale while keeping ownership costs lean.

- Personio, also a Core Leader, is in trending upwards while maintaining Lower TCO, strengthening its reputation as one of the most cost-effective and user-friendly HCM suites for SMEs and fast-scaling enterprises.

- IRIS Staffology and Kelio both made gains as Strong Performers with Lower TCO ratings. Showing that regional players with focused offerings can capture attention by being both affordable and pragmatic.

- On the Specialist side, LumApps is accelerating with a Lower TCO, highlighting that employee experience platforms can expand impact without inflating budgets.

Cost Still Matters – TCO Highlights

Fosway’s inclusion of Total Cost of Ownership is particularly useful. While global leaders like Workday, SAP SuccessFactors, and Oracle Cloud HCM continue to dominate with Higher TCO, it’s the challengers and newer entrants that stand out for cost-effectiveness:

Cezanne, HiBob, Personio, LumApps, IRIS Staffology, Sympa, and Kelio all hold Lower TCO ratings. Proof that innovation and affordability can coexist.

Practical Buying Tips for 2025

For organisations reviewing their Cloud HR investments, here are three lessons from this year’s Grid:

- Balance Brand Strength with Value: Big-name suites deliver scale but often at Higher TCO. Mid-market and challenger suites may offer faster ROI and leaner implementation.

- Look Beyond the ‘Top Right’: As Fosway reminds us, every zone has value. Match the vendor’s strengths to your context, whether that’s workforce size, regulatory complexity, or AI readiness.

- Interrogate TCO in Detail: Go beyond licence costs. Include implementation, ongoing admin resources, and future AI pricing. Vendors with Lower TCO ratings are not just cheaper upfront, they’re proving more cost-resilient over three years.

Where the Cloud HR Industry is Heading – RSA and Globally

Globally, the HR Cloud market is moving beyond digitisation towards AI-enabled work design. Fosway points out that the big challenge is not just automating HR tasks, but redesigning work itself. Deciding which functions sit with people and which with AI agents. Large HCM suites are racing to embed agentic AI, real-time payroll and workforce management into their platforms.

Locally in South Africa, adoption patterns are slightly different. Many enterprises already run SAP or Oracle as their system of record, but mid-market organisations are now looking closely at affordable, modular suites like HiBob and Personio. The drivers here are cost sensitivity, B-BBEE compliance, and the need for frontline workforce management in industries like retail, mining, and financial services.

Where global buyers are focused on AI copilots, audit-proof compliance, and multi-country payroll, South African buyers are prioritising practical affordability, rapid implementation, and tangible workforce engagement. That creates a real opportunity for lower-TCO vendors who can deliver speed-to-value.

How South African Companies Can Buy and Implement Better

South African companies often fall into two traps when it comes to HR Cloud tech:

- Overbuying on brand power: choosing the global “leaders” without fully using half the functionality.

- Undervaluing implementation complexity: underestimating the change management and internal capability needed to make the system work in practice.

To make better decisions:

- Start with workforce reality, not vendor promises. Map where your workforce value sits (frontline, professional, hybrid) and select technology aligned to those needs.

- Interrogate local support and compliance. Global vendors don’t always localise payroll, legislation, or language support well for South Africa. Ensure your chosen vendor can evidence this.

- Build for adoption, not just features. A lower-TCO suite that employees use daily is far more valuable than a higher-TCO “strategic leader” that becomes an expensive admin layer.

- Budget for change and governance. Successful implementation requires training, adoption campaigns, and integration with finance and operations. Not just IT.

For South Africa in particular, the winning formula is clear: think global standards, buy for local context, and implement with a people-first lens.

Do’s and Don’ts for HR Cloud Buying in 2025

Do’s

✅ Do assess vendors on Total Cost of Ownership, not just licence price.

✅ Do test the vendor’s AI roadmap and ensure it aligns with your future of work vision.

✅ Do ensure localisation (payroll, compliance, language) before signing global contracts.

✅ Do budget for change management and adoption, not just system go-live.

✅ Do balance innovation with usability. The best system is the one your people actually use.

Don’ts

❌ Don’t default to the “biggest brand” if your organisation won’t use half the features.

❌ Don’t underestimate the internal resources needed to run and govern the system.

❌ Don’t assume global vendor compliance covers South Africa’s regulations. Always validate.

❌ Don’t get distracted by shiny AI features without linking them to measurable outcomes.

❌ Don’t rush procurement. Align vendor selection to your HR and business strategy first.